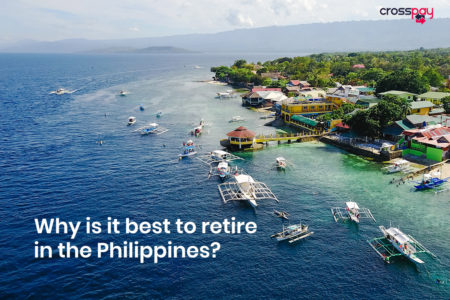

Lifestyle

Why is it best to retire in the Philippines?

Retirement age is the age at which a person intends to settle down peacefully, free of work stress, and to enjoy the rest of their life. The initial phase of our lives is a race to fulfil financial goals and to secure the future for us and our loved ones. These financial goals include standard of living, quality education, investments, insurance and also retirement planning. Retiring abroad has been observed […]

October 19, 2021